Motion vs. Progress: An Insurance Industry Retrospective

Part 3: The $1.6M Problem (Or: Why Your Most Valuable Asset Is Walking Out the Door)

A SparrowHawk Year-End Retrospective

The insurance industry is about to lose its most valuable asset.

Not buildings. Not technology. Not carrier relationships.

Institutional knowledge.

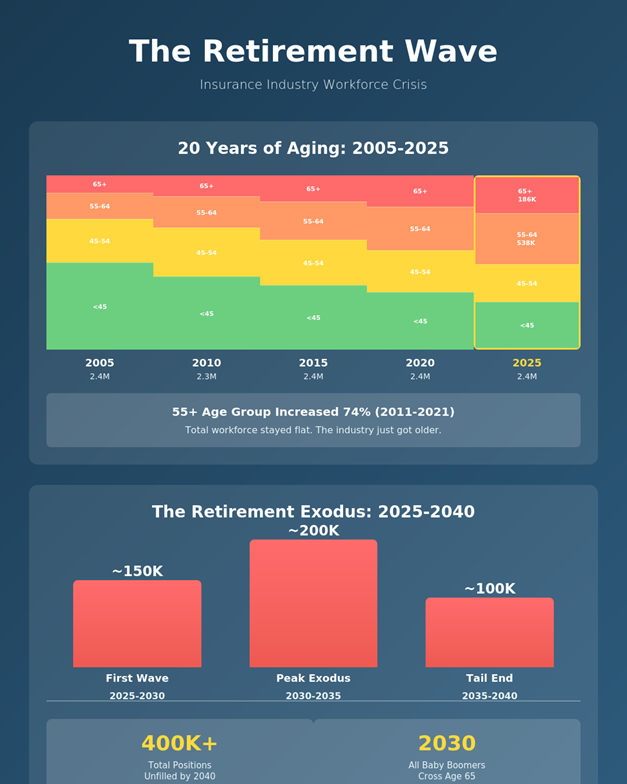

Over the next 15 years, 50% of the insurance workforce will retire. That's more than 400,000 positions that will go unfilled, according to the US Chamber of Commerce. Four hundred thousand jobs where decades of expertise simply walks out the door.

The average insurance producer is now 49.9 years old. The average shareholder is 54.4 years, per Reagan Consulting's latest Best Practices Study. The median age across the industry is 45, compared to 42.2 for the overall US workforce.

We're not just losing headcount. We're losing the people who know how to underwrite a complex fleet risk by instinct. Who can spot coverage gaps in a 60-second conversation. Who've built relationships with brokers over 20 years.

That knowledge doesn't live in your management system. It lives in their heads.

And we have maybe 5-7 years before a massive chunk of it retires.

The Bucket Is Leaking Faster Than We Can Fill It

The good news: Universities are responding.

Temple. Ohio State. Kent State. LSU Shreveport. Faulkner. Ohio Dominican. There are now 57 insurance bachelor's degree programs nationwide offering Risk Management & Insurance, Actuarial Science, and related fields.

The bad news: It's not nearly enough.

These programs graduate a few hundred students per year combined. We're losing 400,000+ professionals over the next 15 years. As the kids say these days, “the math ain’t mathing”.

Even if every single graduate went into commercial insurance (they won't), even if retention was 100% (it's not), even if they could immediately replace a 30-year veteran's institutional knowledge (they can't), we'd still be massively short.

The bucket is leaking faster than we can fill it.

Which means the expertise we still have becomes exponentially more valuable with each passing year.

So How Are We Using That Expertise?

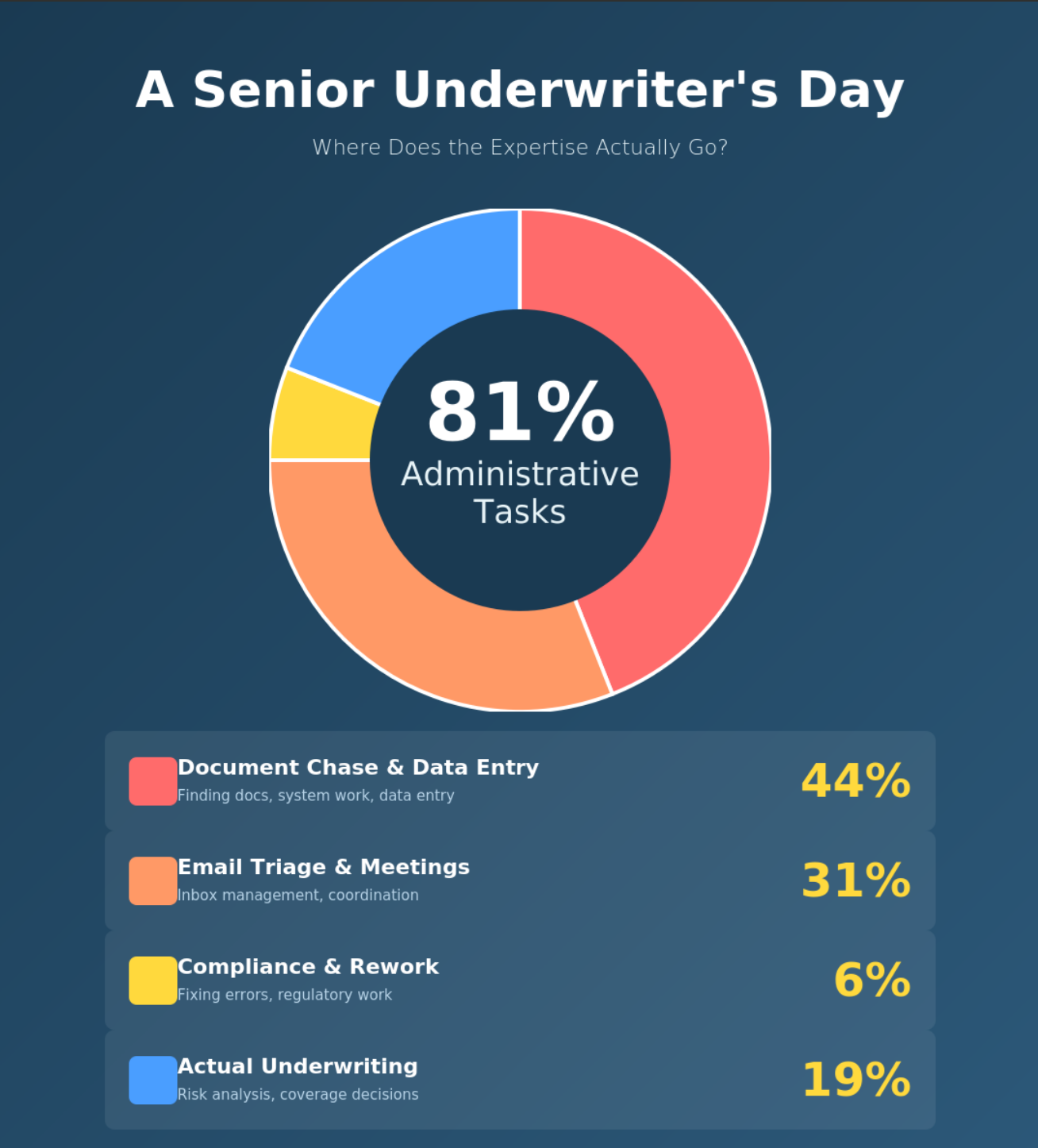

Here's what a senior underwriter's day actually looks like.

6.9 hours on administrative work.

1.6 hours on actual underwriting.

Let that sink in for a moment.

Even at well-established carriers handling large commercial lines, underwriters spend 30-40% of their time on administrative tasks like data entry and manual analysis, according to McKinsey. Document chasing. Email triage. System navigation. Excel tracker updates. Compliance corrections.

Work that doesn't require 15 years of underwriting expertise.

Work that could be handled by someone making $25 per hour instead of $75 per hour.

But here's what really matters: It's not just about cost efficiency.

Every hour spent on administrative work is an hour NOT spent:

Transferring knowledge to junior staff

Mentoring the next generation

Building strategic broker relationships

Solving complex underwriting problems

Documenting processes before they retire

We don't have 10 more years to waste these people on document chase.

We have maybe 5-7 years before they're gone.

The Revenue Opportunity Cost

Let's talk about what this actually costs.

Not in "wasted labor" terms. In lost revenue terms.

A senior producer generates $2 million in revenue annually. If they're revenue-focused 100% of the time (we know that’s not the case or feasible) that's roughly $1,000 per revenue-generating hour.

But they're only spending 90 minutes per day on revenue activities.

That's 6.5 hours of lost revenue opportunity. Daily.

6.5 hours × $1,000/hour × 250 working days = $1.625 million in unrealized revenue per producer annually.

Multiply that by your producer headcount.

This isn't a cost problem. This is a revenue problem.

And it compounds. Because that $1.625 million isn't just this year's revenue. It's:

- Lifetime client value of relationships never built

- Referrals that never happen

- Strategic accounts that go to competitors who showed up first

- Knowledge that never gets transferred before retirement

Want to measure this in your own shop?

Track your top producers for one week. Categorize every 30-minute block as either revenue-generating (client meetings, broker consultations, strategic planning, mentoring) or non-revenue (document chase, data entry, system corrections, email triage).

Then do the math on what reallocating just 4 hours per day would mean for your top line.

The number will wake you up.

Why Generic BPO Doesn't Solve This

"We already tried outsourcing. It didn't work."

We hear this constantly.

And we get it. Because most BPOs treat insurance like it's customer service for a cable company.

They send you someone in a call center who needs to be walked through every submission. Who doesn't understand the difference between surplus lines and admitted paper. Who requires your senior underwriter to QA every piece of work, which defeats the entire purpose.

That's not freeing your talent. That's giving them more babysitting.

The problem isn't outsourcing. The problem is treating complex insurance operations like they're data entry.

E&S risks aren't standardized. Program business has nuance. Surplus lines have regulatory complexity that varies by state.

You can't hand this to someone who learned "insurance" from a training manual last month and expect them to be a steward of your client relationships.

What Actually Works: Strategic Partnership, Not Just Processing

Here's the difference.

Generic BPO: You send work to a vendor. They process it. You fix their mistakes. Your senior staff still can't focus because they're managing the outsourcing.

Strategic Partnership: You work with people who actually understand E&S insurance. Who bring judgment and context. Who act as stewards of your accounts, not just vendors moving paperwork.

SparrowHawk's team averages MBA-equivalent education levels with years of E&S insurance expertise. We understand surplus lines, program business, complex commercial risks.

But more importantly: We deliver 99.9% accuracy.

Not "pretty good." Not "better than most." 99.9%.

Which means your senior underwriters aren't spending their time fixing our work. They're spending their time doing what you hired them to do: analyze risk, negotiate terms, build relationships, mentor juniors.

Two Personas: Revenue Apologist vs. Revenue Multiplier

Here's what this looks like in practice.

Your Team as Revenue Apologists (current state):

When your producers are drowning in admin work, they become professional apologists:

"Sorry, I haven't gotten to that renewal quote yet - still chasing loss runs."

"I know we're behind on those submissions, I'll get to them this week."

"The endorsement is taking longer than expected - system issues."

"I'm working on it" becomes their most common phrase.

They're explaining delays. Apologizing for missed deadlines. Reactive instead of proactive.

Not because they're bad at their jobs. Because they're doing three jobs.

Your Team as Revenue Multipliers (properly supported state):

When administrative execution is handled by people who actually know insurance, producers become force multipliers:

Calling clients BEFORE renewals are due.

Strategic account planning that identifies growth opportunities.

Building relationships that generate referrals.

Proactively identifying coverage gaps.

Mentoring junior staff so your institutional knowledge multiplies instead of disappearing.

Closing complex deals that require expertise but would have been lost to competitors who weren't buried in admin work.

They're not explaining why things haven't happened. They're making things happen.

The Infrastructure That Enables Multiplication

We're not the multiplier. Your producers are the multiplier.

We're the infrastructure that makes multiplication possible.

You can't automate institutional knowledge transfer. You can't automate strategic broker relationships. You can't automate complex risk analysis.

What you can do: Free your expensive talent to focus on what only they can do.

Document chase? We handle it.

First-level submission review for completeness? Done.

Renewal timeline management and escalation? Top priority.

Data entry from standardized forms? Practically in our sleep.

Your $75/hour underwriters keep:

- Risk analysis and coverage decisions

- Complex negotiations and exception handling

- Strategic broker relationship management

- Mentoring and knowledge transfer

The critical difference: When you need something fixed or a question answered, you're not submitting a ticket and waiting in a queue.

You're messaging your Process Executive directly.

One email or DM gets a cert corrected, a renewal packet updated, or a quote remarketed - often in minutes. No middlemen. No lost time. No managing the vendor.

The Window is Closing

According to Accenture's 2024 insurance industry analysis, carriers are already reallocating senior underwriters to higher-value areas such as business development and negotiation.

The firms that reallocate talent now will have:

Stronger competitive positioning (while competitors' producers are still chasing documents)

Captured institutional knowledge (through mentoring programs that finally have time to happen)

Better broker relationships (proactive vs. reactive)

Higher revenue per producer (more capacity for complex, high-value deals)

The firms that wait will have:

Retiring expertise that was never documented

Burned-out producers who leave for less stressful roles

Lost market share to competitors who freed their talent to compete

A junior workforce that never got trained

This Isn't About Cost. It's About Survival.

You can't manufacture more time. Your senior producers have 5-7 years before retirement. Maybe less.

Every month spent with them doing $25/hour work is a month their $150/hour expertise doesn't get transferred, doesn't get leveraged, doesn't get multiplied.

The E&S market hit $130 billion. Nuclear verdicts jumped 110%. Capacity is constrained.

The firms that win are the ones whose talent isn't wasted on administrative work.

Next week in Part 4: What actually works when you stop treating symptoms and start fixing root causes. The unglamorous operational work that separates the 5% from the 95%.

Sources:

-US Chamber of Commerce, insurance workforce projections

Reagan Consulting, 2024 Best Practices Study

McKinsey Global Institute, "Insurance productivity 2030: Reimagining the insurer for the future" (October 2020)

Accenture, "5 reflections on the insurance industry in 2024" (January 2025)

Bureau of Labor Statistics, insurance industry demographics

Multiple university insurance program curricula (Temple, Ohio State, Kent State, LSU Shreveport, Faulkner, Ohio Dominican)