The Motion vs. Progress Problem: A 4-part Insurance Retrospective.

Part 1: Six Conferences, One Conclusion: We're All Pretending This Is Fine

A SparrowHawk Year-End Retrospective

I spent quite a bit of time on the road this year, living out of suitcases and in conference centers. By my third conference, the part of my brain that constantly runs pattern recognition games in the background picked up on two distinct things that turned into a "buzzword bingo" of sorts:

Vendors:

You could almost drag-and-drop the "synergy" and "revolutionary" adjectives alongside the "digital transformation/revolution" lingo into each vendor pitch: "AI-powered, cloud-based, seamless integration, strategic partnership."

Oh, and don't forget that AI now lives in every piece of technology and every part of the insurance lifecycle—from submissions to predicting when to start the coffee maker because underwriters have been at their desks for longer than 90 minutes.

Insurance Professionals:

Insurance is innovating faster than ever before. New and exciting programs, lines of business, MGAs, and unique model agencies are starting up daily. But there were telltale symptoms of being victims of a booming market everywhere.

Here's what I learned: Everyone's pretending this is fine.

The public conversation—the panels, the keynotes, the booth pitches—was all about growth and innovation. The E&S market is booming. Technology is transforming operations. We're entering a new era of efficiency.

The private conversation—the one that happens after the second drink at the hotel bar—was very different:

"We can't keep up with submission volume."

"Our underwriters are spending half their time on admin work."

"Renewals are falling through the cracks, even with all these technological safeguards."

"We have an outsourcing partner, but there are times we feel they don't fully understand what they're processing."

"We're constantly fixing errors."

This is the uncanny valley of operational excellence: operations that look functional from the outside but are barely holding together internally. And the gap between public optimism and private chaos is getting wider.

The Numbers Don’t Lie

Let's talk about what's actually happening in the market.

The E&S market just finished its seventh consecutive year of double-digit growth, hitting nearly $130 billion in direct premiums written in 2024. Surplus lines premiums surged 13.2% year-over-year to $46.2 billion in the first half of 2025 alone.

That's massive growth. That's success, right?

Except here's what else is happening: Nuclear verdicts rose from a median of $21 million in 2020 to $44 million in 2023.

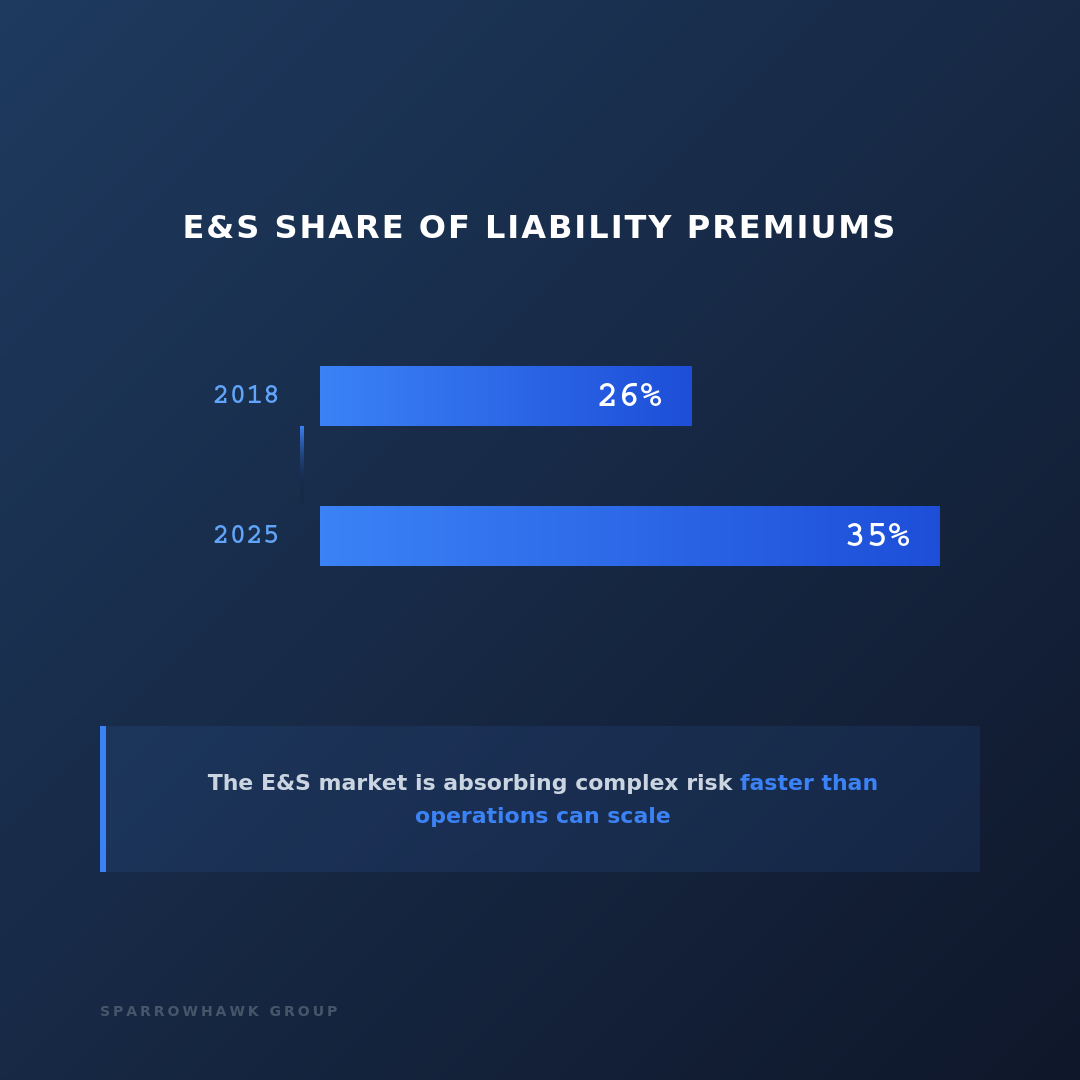

E&S lines now represent 35% of liability premiums, up from 26% in 2018. Complex risks that used to be handled by admitted carriers are flooding into specialty markets.

So yes, premium is up. But complexity is up faster. Regulatory requirements are booming as fast as revenue growth. Claims severity is more important now than it ever has been.

And operations? Operations are barely keeping pace.

The BPO Solution

Meanwhile, the insurance BPO market is projected to grow from $7.2 billion in 2024 to $12 billion by 2034. Everyone's outsourcing. 72% of U.S. insurance companies integrated robotic process automation into claims processing in 2024. 62% of insurers now use AI-driven workflows.

Touchdown. Collective high-fives all around, right? Just outsource the chaos, automate the bottlenecks, and watch the efficiency gains roll in.

Except that's not what I heard at these conferences.

What I heard was: "We hired a BPO firm and now we're fixing their mistakes." And: "Our automation is creating more work, not less." And: "We bought the software, implemented the system, and everyone still does it the old way."

The market is growing. The technology is getting better. The outsourcing options are multiplying.

And operations are still breaking.

What’s Actually Breaking

The conversations I kept having—with ops leaders, insurance executives, and boots-on-the-ground underwriters, producers, and CSRs alike—revealed a consistent pattern while emphasizing different levels of the pain chain:

Submission backlogs that spike from manageable to catastrophic during hard market periods. Underwriters spending 30%+ of their time on document prep and data entry instead of actually underwriting. Brokers getting contacted a week before renewal instead of 60-90 days out. Finance teams spending more time fixing reconciliation errors than managing collections.

One MGU principal told me his team processed 200 submissions a month with duct tape and hustle. Then volume hit 800. "Everything we'd been ignoring fell apart," he said. "We thought we had workflows. We had workarounds."

That's the uncanny valley: the difference between operations that appear to work and operations that actually work becomes obvious only under pressure. And the E&S market is applying a lot of pressure. The tests are rarely stress-free, which is when you have the least capacity to consider long-term sustainability for workflow and operational success.

The Gap

Here's the core problem: The insurance industry is growing faster than its operational capacity to keep up.

Premium growth doesn't automatically translate to operational capability. In fact, rapid growth often exposes operational weakness. The workarounds that functioned at 200 submissions per month collapse at 800. The manual processes that were "good enough" for $50 million in premium become disasters at $200 million. Think of the infamous Apollo 13 movie scene about being off by a minuscule amount in the calculations, resulting in missing the moon. Scale matters at every point of the success journey.

And the solution most companies are reaching for—generic BPO firms, off-the-shelf automation, "AI-powered" everything—isn't closing the gap. It's just making the gap less visible until something breaks.

That's the uncanny valley: solutions that are almost right being worse than solutions that are clearly wrong. At least when something is obviously broken, you know to fix it. When it looks like it's working but isn't, you don't realize there's a problem until you're drowning.

What’s Next

So, what's the answer? Is it better technology? Better people? Better processes?

Short answer: It's complicated.

Longer answer: The industry is throwing money at solutions that sound good but don't actually solve the underlying problems. Everyone's talking about AI. Most of them are doing it wrong.

In Part 2, we'll talk about that—the AI buzzword bingo, the MIT study that goes in-depth on AI's 95% failure rate, and why it's important to practice extreme discernment when implementing them. For the record, I'm pro-AI, but I'm hesitant about fast-and-loose adoptions.

So for the next part, kick back, grab your holiday nog or cocktail of choice, and we'll talk shop.